ADHD Women and Money: 3 myths to Shatter

ADHD Women and Money: Taking Charge of Your Finances

If you are a neurodivergent woman who struggles with money, you aren't alone. Managing personal finances can often feel like an uphill battle, especially for women diagnosed with Attention Deficit Hyperactivity Disorder (ADHD). The intersection of ADHD symptoms and financial responsibilities can create unique challenges, leading to higher levels of stress and anxiety. However, by understanding how ADHD impacts financial behaviors and implementing tailored strategies, women can take control of their economic well-being and reshape their money narratives.

The ADHD and Money Experience: Understanding Your Financial Landscape

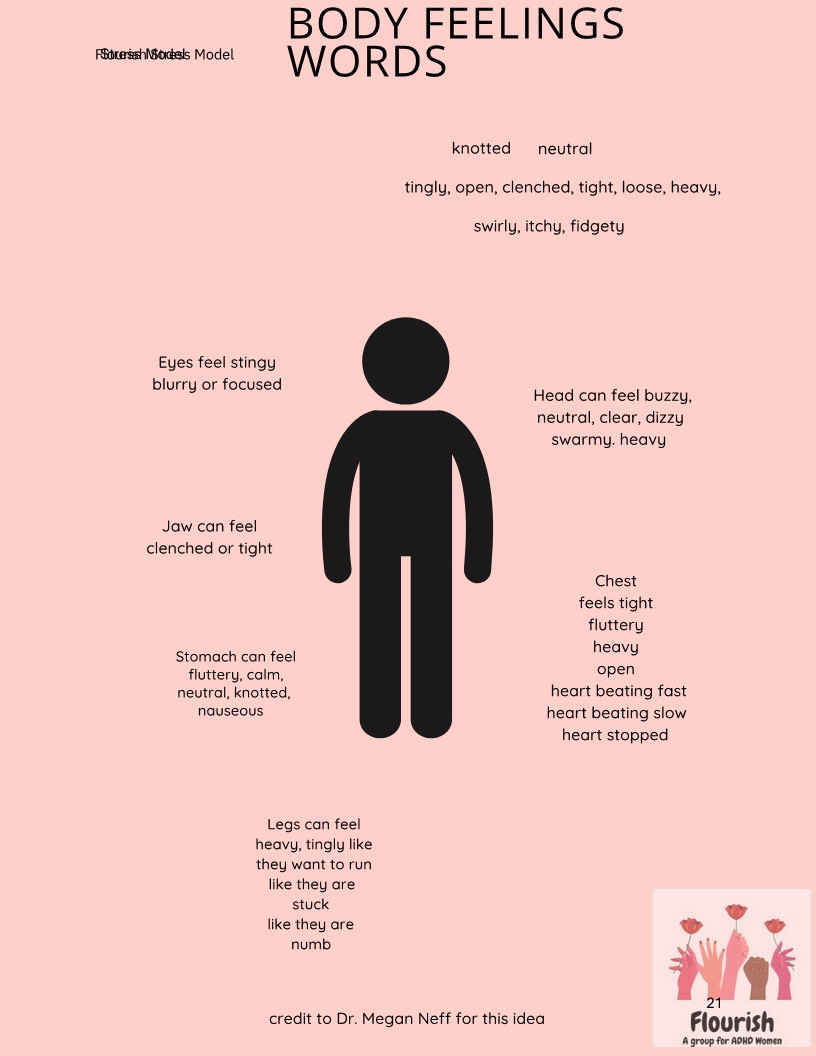

ADHD affects the brain’s executive functions, which can manifest in various ways when it comes to handling money.

It’s essential to recognize that the struggles faced in managing finances often have roots in issues such as time blindness, the need to feel gratified in the moment, emotional regulation, and difficulties with planning rather than a lack of intelligence or capability.

For many women with ADHD, finances may become a source of significant stress:

- Impulsivity can lead to unplanned purchases and overspending.

- Difficulty with organization may result in misplaced bills or forgotten payments.

- Emotional regulation challenges can trigger spending, procrastination, and anxiety, making financial decisions feel overwhelming.

Understanding that these behaviors are linked to ADHD can help alleviate feelings of shame and frustration and pave the way for effective strategies to improve financial health.

Challenging Common Myths About ADHD and Money

Myth 1: “I’m just not responsible enough with money.”

Many women with ADHD internalize negative thoughts about their financial responsibility. However, it’s important to reframe this perception. Financial management isn’t just about willpower or discipline—it's about finding the right systems that work for your unique brain chemistry.

Negative thoughts and beliefs prevent you from exploring what could work or even looking at your budget.

For instance, neurodivergent individuals often perform better with engaging and dynamic approaches rather than rigid financial systems.

Embrace the idea that you can develop a financial strategy tailored to your strengths.

Myth 2: “I can’t stick to a budget.”

The traditional approach to budgeting can feel daunting, especially when ADHD makes it hard to focus on dull tasks. Rather than forcing yourself into conventional budgeting systems that seem unmanageable, explore creative budgeting methods.

Consider using:

- Visual budgeting tools (like colorful spreadsheets or apps)

- Envelope systems where cash allocations make spending tangible. This way you know exactly how much is in there and how much you have for the week.

- Gamification techniques for tracking spending and savings goals

Myth 3: “I’m just bad with money.”

Feeling like you’re “bad” with money is a common false belief. It hold you back from exploring what might help you be better with money.

Yet, the truth is that your experience with money reflects your unique challenges—not your intelligence or potential. It’s crucial to recognize that ADHD impacts financial decision-making processes, but that doesn’t equate to a lack of ability.

Research shows that individuals with ADHD often excel in creative problem-solving and thinking outside the box. Utilize these strengths to approach your finances differently.

Actionable Strategies for Financial Management

Neurotypical strategies make you feel stupid and insulted. Sari Solden calls them duh messages. Just keep a budget, etc. These things don't help.

Here are several empowering strategies specifically designed to help women with ADHD navigate their financial landscapes more effectively:

1. Set Up a Routine

Establishing a consistent financial routine can help alleviate stress and create a sense of control:

- Designate a specific day each week to review finances.

- Check your bank account, review expenditures, and plan for the upcoming week.

- Use timers to create a sense of urgency that may encourage focus.

2. Utilize Technology

Embrace apps and tools designed to make financial management easier:

- Budgeting apps that send reminders for due dates and spending limits.

- YNAB (You Need A Budget): YNAB Official Website

- Goodbudget: Goodbudget Official Website

- PocketGuard: PocketGuard Official Website

- Honeydue: Honeydue Official Website

- Mvelopes: Mvelopes Official Website

- Wally: Wally Official Website

- Digit: Digit Official Website

- Digital wallets are used to track expenses in real time without the need for paper receipts.

- Automation services that can manage bill payments to avoid late fees.

Here are two very cool apps that are helpful for tracking expenses:

3. Practice Self-Compassion

Financial challenges can sometimes feel unbearable, but practicing self-compassion is critical to resilience:

- Acknowledge that ADHD presents unique hurdles but that you are navigating them.

- Celebrate small victories, whether paying a bill on time or sticking to your budget for a week.

- Remember that progress, not perfection, is the goal.

4. Seek Professional Guidance

Consider working with a financial advisor experienced in supporting neurodiverse clients. They can provide tailored advice and strategies according to your specific needs. Furthermore, joining community groups focusing on ADHD and personal finance can give you valuable insights and support.

Conclusion: Rewriting Your Financial Story

Women with ADHD often face heightened challenges when it comes to finances, but these obstacles don’t define your capabilities or future. By understanding how ADHD affects financial behaviors and employing tailored strategies, you can take control of your financial journey.

Remember, it’s essential to find what works best for you. By embracing your unique thought processes and reframing the traditional financial narratives, you’ll feel more empowered and turn your financial goals into achievable realities. No matter how small, every step you take is a step toward a brighter financial future.

Let’s reshape the conversation about ADHD and finances—your story is yours to write.

-

ADHD and Money FAQ

1. How does ADHD influence financial decision-making? ADHD can lead to both avoidant and impulsive financial decisions due to challenges with focus, time management, and impulse control. You might procrastinate on important financial tasks, like paying bills or planning a budget, because they seem overwhelming or tedious (avoidance). Conversely, you might make quick, impulsive purchases without considering the long-term consequences (impulsivity). Recognizing these patterns is crucial. By understanding how ADHD affects your decision-making process, you can implement strategies, such as setting up reminders, breaking tasks into smaller steps, or using budgeting tools that cater to your needs, helping you make more deliberate and thoughtful financial choices.

2. Are adults with ADHD more likely to face financial challenges? Yes, ADHD may contribute to lower income, increased debt, and difficulties with financial planning, but these challenges can be managed with the right tools.

3. Why might budgeting and saving be tricky for adults with ADHD? Budgeting and saving can be tough due to challenges like impulsivity and a preference for immediate rewards, but tailored strategies can empower financial management.

4. What is temporal discounting, and how can it impact finances? Temporal discounting prioritizes immediate rewards over future gains, which is common in ADHD. Understanding it helps balance short-term satisfaction with long-term success.

5. What strategies can help adults with ADHD manage finances? Setting routines, using technology, practicing self-compassion, and seeking professional guidance are effective strategies.

6. How can impulsive spending be managed in adults with ADHD? Manage impulsive spending through gamification, envelope systems, and visual tools that make budgeting engaging and fun.

7. How can ADHD affect future financial planning, and how can you overcome this? ADHD can make long-term planning challenging, but breaking goals into manageable steps and using supportive tools can build a secure financial future.

8. What is emotional regulation's relationship to ADHD and money? Emotional regulation influences financial habits, and understanding this connection allows for positive change and easier financial management.

9. Is there a connection between ADHD and financial competence? ADHD may impact financial competence, but these skills can be developed with patience and the right resources.

10. Can therapy or medication improve financial decision-making in adults with ADHD? Therapy and medication can improve financial decision-making by managing ADHD symptoms. Exploring these options can lead to better financial habits.